The Netherlands - Global Leader in EV Charging

2024-06-17

HEBEI DONDUO ELECTRIC CO.LTD

www.chargerpile.com

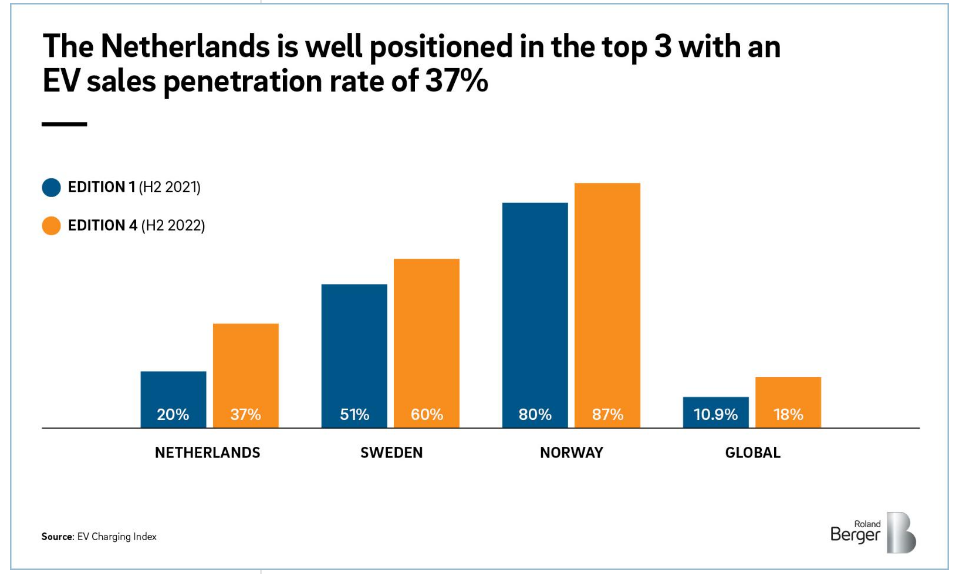

In 2018, the penetration rate of new energy EV in the Netherlands was only 5.5%. It quickly rose to 13.7% in 2019, and soared again to 20% in 2020. In 2021, the penetration rate of electric vehicle in the Netherlands ranked first in the EU with 37%, becoming the global leader in EV charging market.

What enabled the Netherlands to become the global leader in just a few years? All is due to its adoption of EV charging infrastructure and its strong taxation policies and incentives.

Firstly, the Netherlands is a leader in the adoption of EV charging infrastructure

There had been a research that analyzed the relationship between numbers of electric vehicle sales and population size in the Netherlands, as well as government investment in EV infrastructure and the number of charging stations per electric vehicle. It found that the Netherlands was the most advanced in terms of infrastructure and technology promotion, followed by Norway and Sweden.

Topping the list of Dutch infrastructure investments is its EV charging infrastructure. The Netherlands has more public charging points per vehicle than any other country, with one charging point for every five electric cars on the road. By September 2021, the total number of regular charging points has increased to 78,279 and the total number of fast charging points has increased to 2,524. More than 49,228 charging points are public (available to the public 24/7) and 38,047 charging points are semi-public (limited public use). Only South Holland (The Hague and Rotterdam regions) has over 21,896 regular charging points, making it the most electricity-friendly province in the Netherlands.

Secondly, the Dutch government has formulated strong taxation policies and incentives.

- Car Purchasing Tax Incentives:

Pure electric vehicles are exempt from road tax.

Registration tax is exempted for zero-emission vehicles.

- Personal Car Tax Incentives:

Zero-emission vehicles are exempt from tax, and plug-in hybrid vehicles are subject to a 50% tariff.

- Cooperate Car Tax Incentives:

1. Enterprises using zero-emission vehicles enjoy the lowest tax rate of 16%;

2. The maximum tax and fee for pure electric vehicles shall not exceed 30,000 Euros; There is no upper limit for fuel vehicles.

- Purchasing Subsidy:

In 2020, the Dutch government proposed a new subsidy plan. The Dutch cabinet approved the new electric vehicle subsidy policy for 2020-2025 (the annual total budget needs to be reviewed). A total of 17.2 million Euros in subsidies were provided in 2020, of which 10 million Euros were used to subsidize new electric vehicles and 7.2 million Euros were used to subsidize second-hand electric vehicles. It is clarified that a subsidy of 4,000 Euros will be provided for the purchase or rental of new electric vehicles (with a range of ≥120km and a price of 12,000 to 45,000 Euros) and a subsidy of 2,000 Euros for second-hand electric vehicles.

From EV infrastructure and taxation policies, the Netherland has made an successful and vivid experience which is worthy of reference by more countries. To promote the sustainable development of green energy, we cant only make slogan propaganda, it needs more comprehensive policies, mainly economic, to encourage transportation users to make more sustainable choice.

RELATED INFORMATION